Introduction

Last week, Sarah from Pennsylvania was halfway through her morning coffee ritual when she hesitated—her International Delight hazelnut creamer stared back from the fridge, but X was ablaze with recall warnings. She wasn’t alone. Searches for “coffee creamer recalled” spiked as 75,054 bottles vanished from shelves across 31 states, shaking a nation where coffee is king and creamers reign supreme. At tutudata.ai, we’ve brewed up a deep dive with four charts to unpack this chaos—connecting a single recall to America’s coffee habits, generational divides, and a booming market. This isn’t just about spoiled creamer; it’s a window into what we pour into our mugs and why.

The Data: Four Charts Unraveled

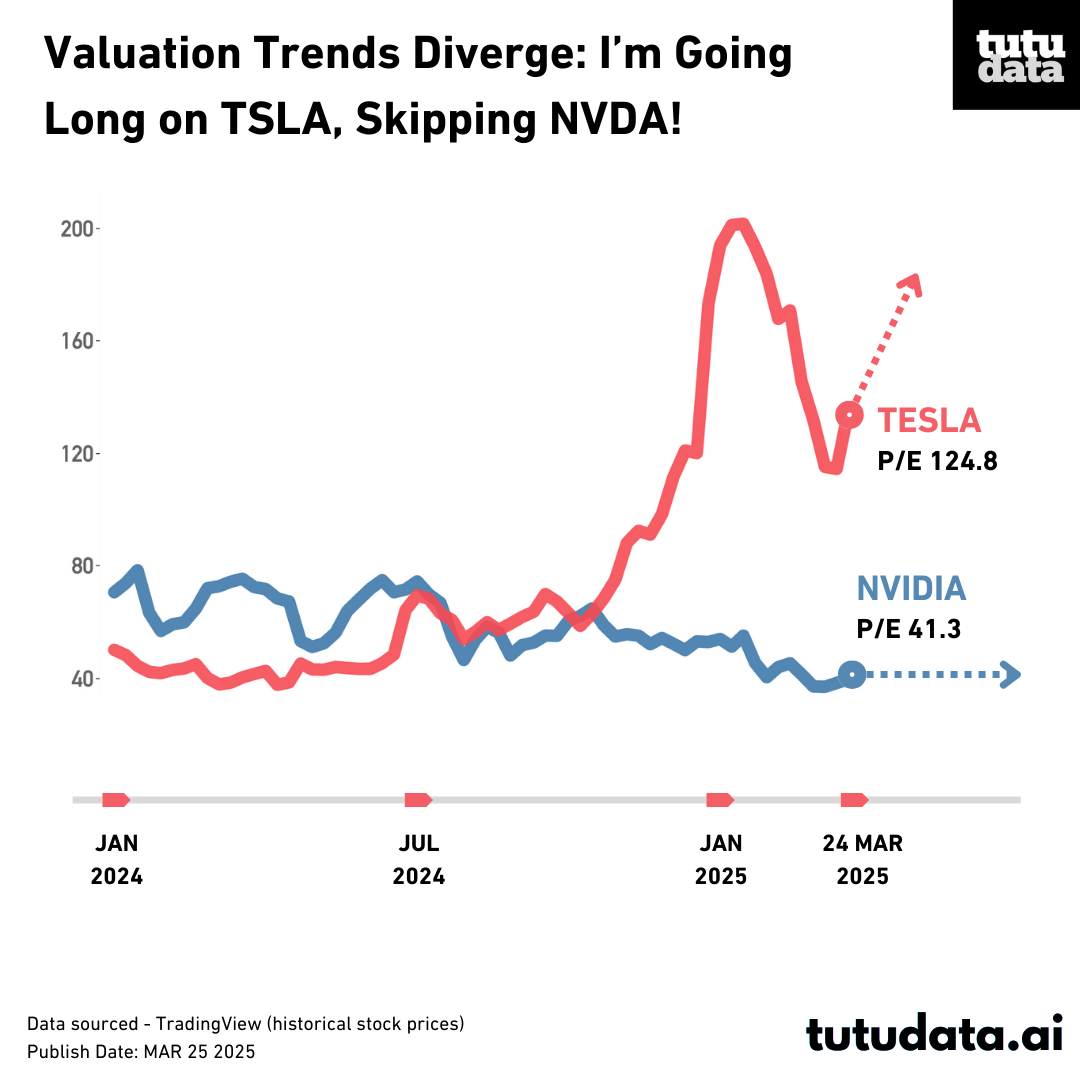

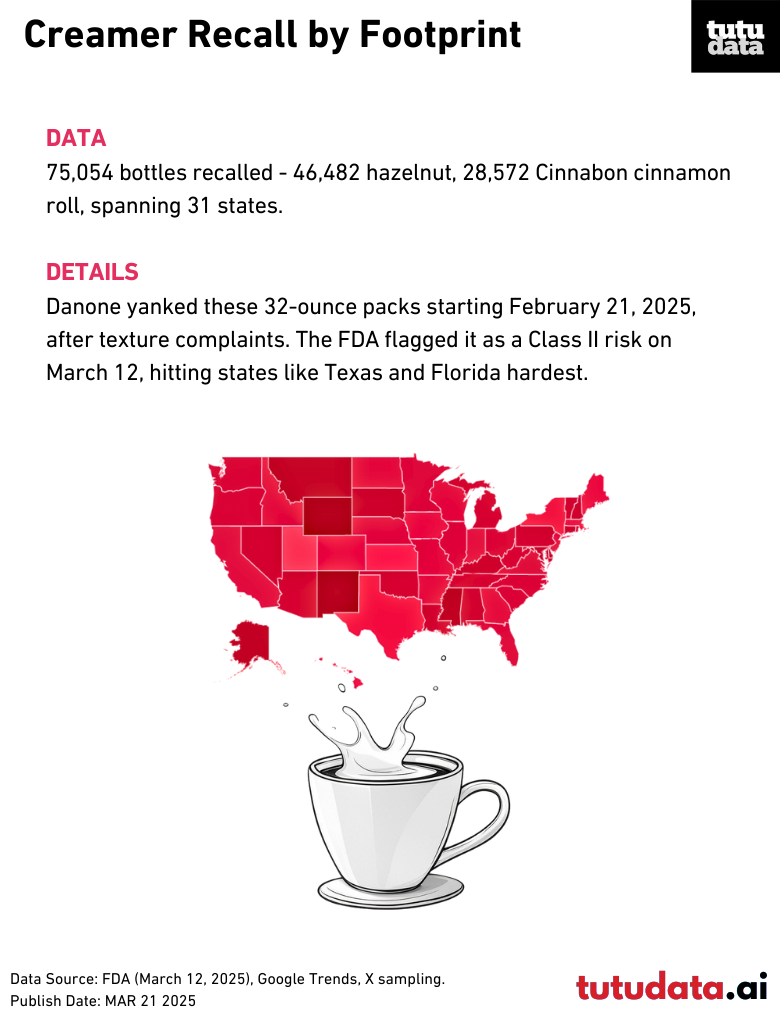

On February 21, 2025, Danone, the parent of International Delight, pulled these 32-ounce packs after consumers flagged texture issues—think lumpy, off-putting globs instead of smooth cream. By March 12, the FDA classified it a Class II recall, meaning potential temporary health risks, though not life-threatening. X lit up with 3,500 posts, peaking at 1,800 on March 13 as the news broke. The recall hit 31 states, with heavy distribution in coffee-loving hubs like Texas and Florida, per FDA logs. This wasn’t a small hiccup—75,054 bottles is a hefty chunk for a brand synonymous with America’s creamer culture.

A recall this size begs questions: How does a staple like International Delight slip up? Is it a one-off, or a sign of bigger quality cracks in a $2.8 billion industry?

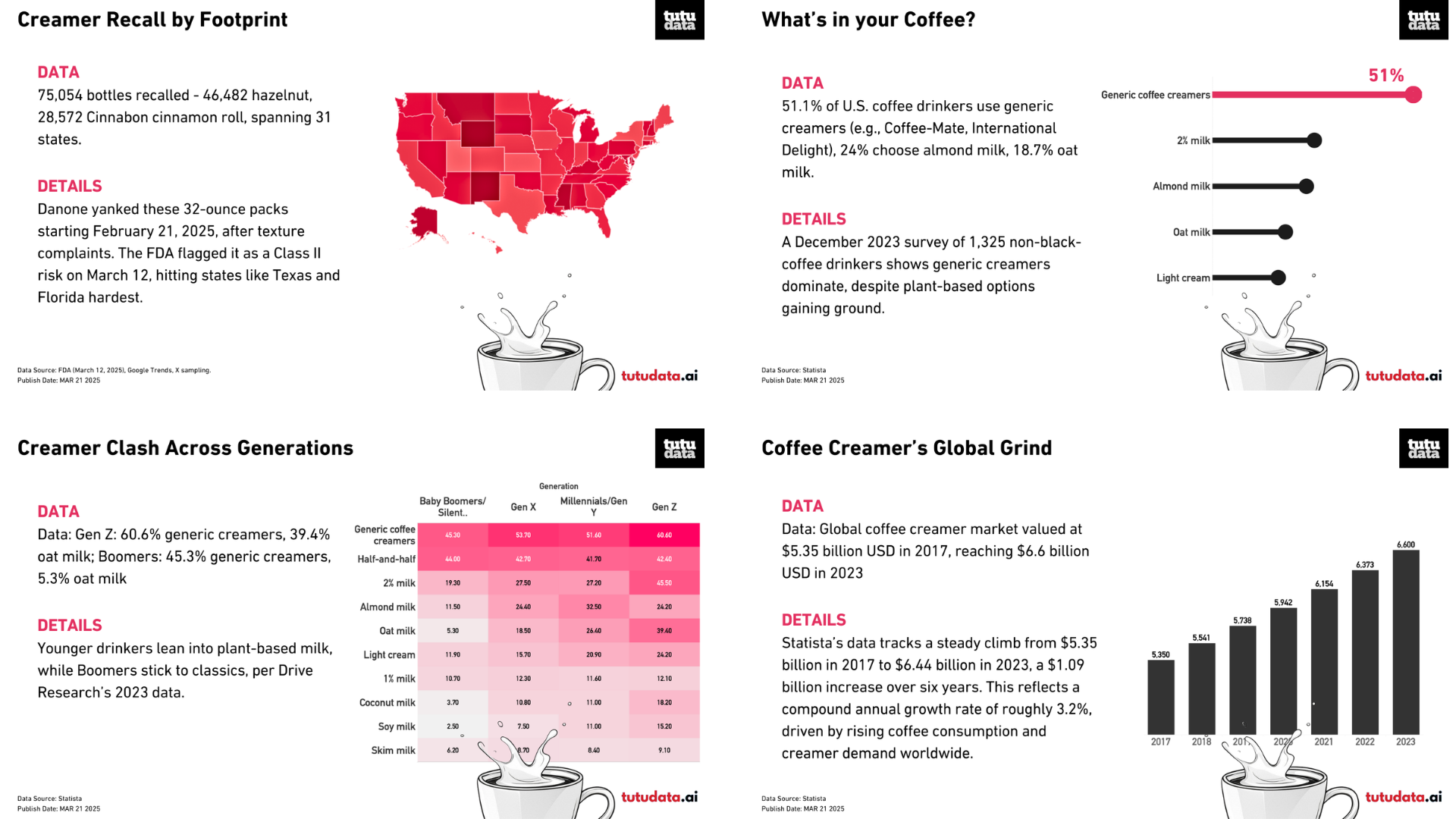

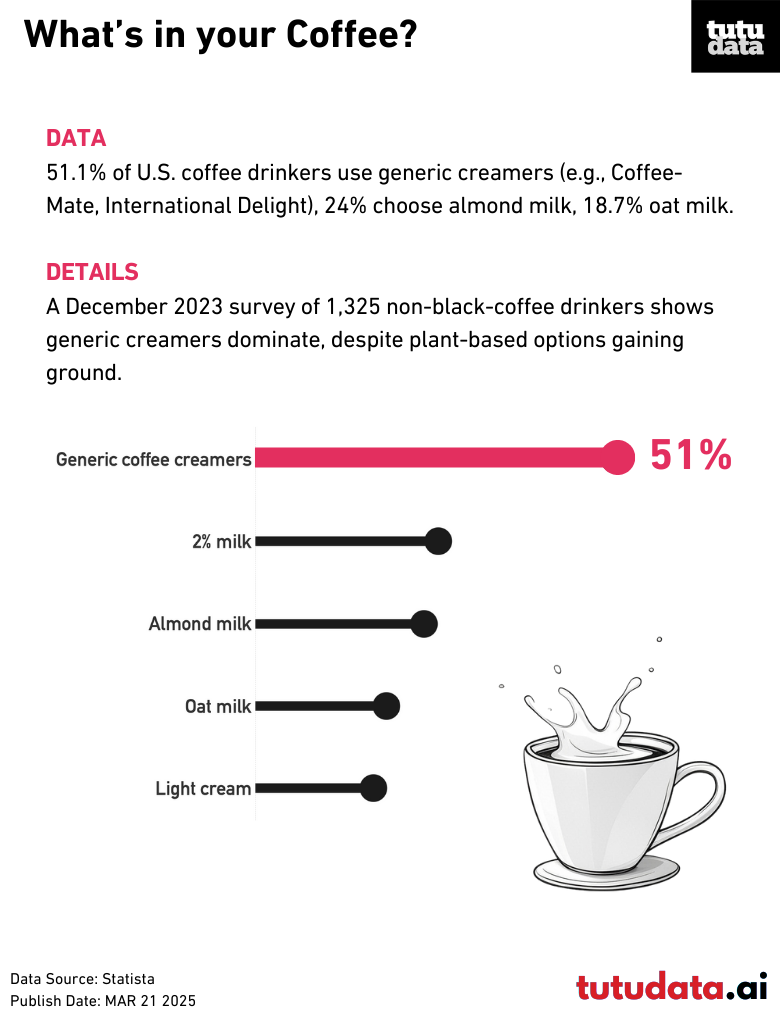

Drive Research’s December 2023 survey of 1,325 non-black-coffee drinkers reveals a clear hierarchy: generic creamers—think the very International Delight now under fire—lead with 51.1%. Almond milk (24%) and oat milk (18.7%) trail, signaling a plant-based push, but traditional creamers hold firm. Statista’s coffee market overview (1248) notes 82% of U.S. adults drink coffee, and with 38.9% adding creamer (1450260), that’s millions of daily pours. International Delight’s recall stings because it’s not niche—it’s the go-to for half the country’s coffee crowd.

The recall hits a sweet spot of vulnerability—generic creamers’ dominance makes their failures loud. But with plant-based options rising, could this dent trust enough to shift the leaderboard?

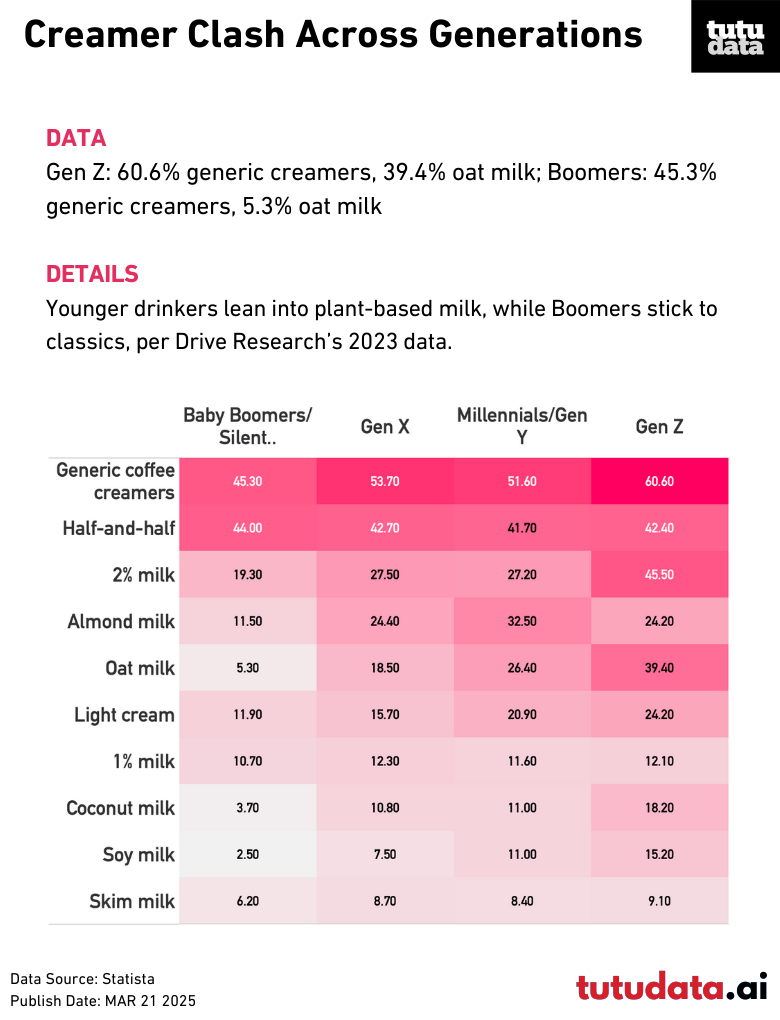

The same 2023 survey breaks it down by age, and the divide is stark. Gen Z piles on generic creamers (60.6%) but also loves oat milk (39.4%), reflecting a dual taste for indulgence and sustainability—multiple answers were allowed, showing their adventurous streak. Boomers, at 45.3% for generics, barely touch oat milk (5.3%), sticking to what they know. Millennials lean into almond milk (32.5%), a nod to the mid-2010s health wave. This split mirrors Edlong’s take: younger drinkers crave plant-based innovation, while older ones cling to classics. The recall, targeting a Gen Z favorite, might nudge them toward those greener options faster.

Generations don’t just sip differently—they signal where creamer’s headed. If Gen Z ditches brands like International Delight post-recall, will oat milk makers seize the day?

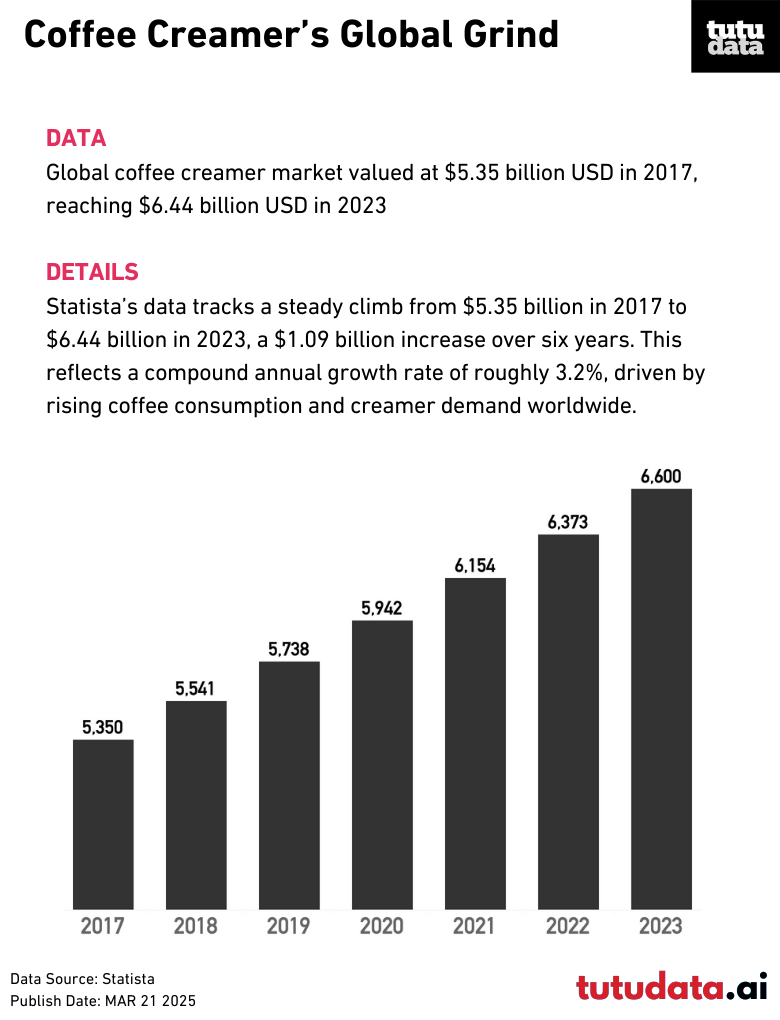

The global coffee creamer market’s growth from 2017 to 2023, tells a story of resilience and expansion. Starting at $5.35 billion, the market weathered the 2020 pandemic—when at-home coffee spiked—and hit $6.44 billion by 2023. This aligns with broader coffee trends: Statista’s U.S. coffee market overview (1248) notes 82% of American adults drink coffee, and globally, consumption’s on the rise (Future Market Insights projects a $33.7B market by 2033). The U.S., a key player, saw 421.8 million units sold in 2023, but this global figure includes Europe’s flavor chasers and Asia’s emerging coffee scenes. International Delight’s recall, while U.S.-centric, taps into this worldwide creamer love—75,054 bottles is a drop in a $6.44 billion bucket, yet it rattled a loyal base.

Creamer’s a juggernaut, but a recall tests its armor. Could quality scares slow a $33 billion trajectory, or is America too hooked to care?

Background:

The recall stems from FDA’s March 12, 2025, Class II designation, sparked by Danone’s February 21 action after texture complaints—no bacteria, just off-putting clumps. X erupted with 3,500 posts, peaking March 13, as 31 states scrambled. Drive Research’s 2023 survey (1,325 respondents) maps consumer habits, while Statista’s coffee stats (1248, 9899, 509174) and Future Market Insights frame a market where coffee’s king—82% penetration—and creamers fuel its reign. Edlong adds flavor: health trends (low-fat, plant-based) are reshaping what we pour.

Wrap-up:

From a 75,054-bottle recall rattling 31 states to a $6.44 billion global market in 2023, coffee creamer’s journey is a brew of chaos and craving. Four charts peel back the layers: a quality stumble for a brand half of U.S. coffee drinkers swear by, a generational tug-of-war between oat milk and classics, and an industry grinding upward despite the hiccups. It’s more than a recall—it’s a snapshot of what fuels our daily cups and where it’s headed. Want the raw scoop on the recall? Check the FDA’s official notice for the gritty details. Curious about the next big data story? Stick with tutudata.ai—our Chart Pulse and Digest pieces uncover the numbers shaping your world, one chart at a time.

Data Sources:

This Chart Digest draws from multiple sources to map the coffee creamer recall and market trends. Recall data is sourced from the U.S. Food and Drug Administration (FDA) announcement on March 12, 2025, Google Trends for search spikes (March 13-20, 2025), and X posts sampled manually (approximately 3,500 mentions). Consumer preferences come from Drive Research’s December 2023 survey of 1,325 U.S. adults, published by Statista in February 2024 (IDs 1327799 and 1450530). Global market size is based on Statista’s data from AB Newswire, tracking coffee creamer value from 2017 to 2023 (ID 886445). All figures reflect the latest available data as of March 21, 2025.