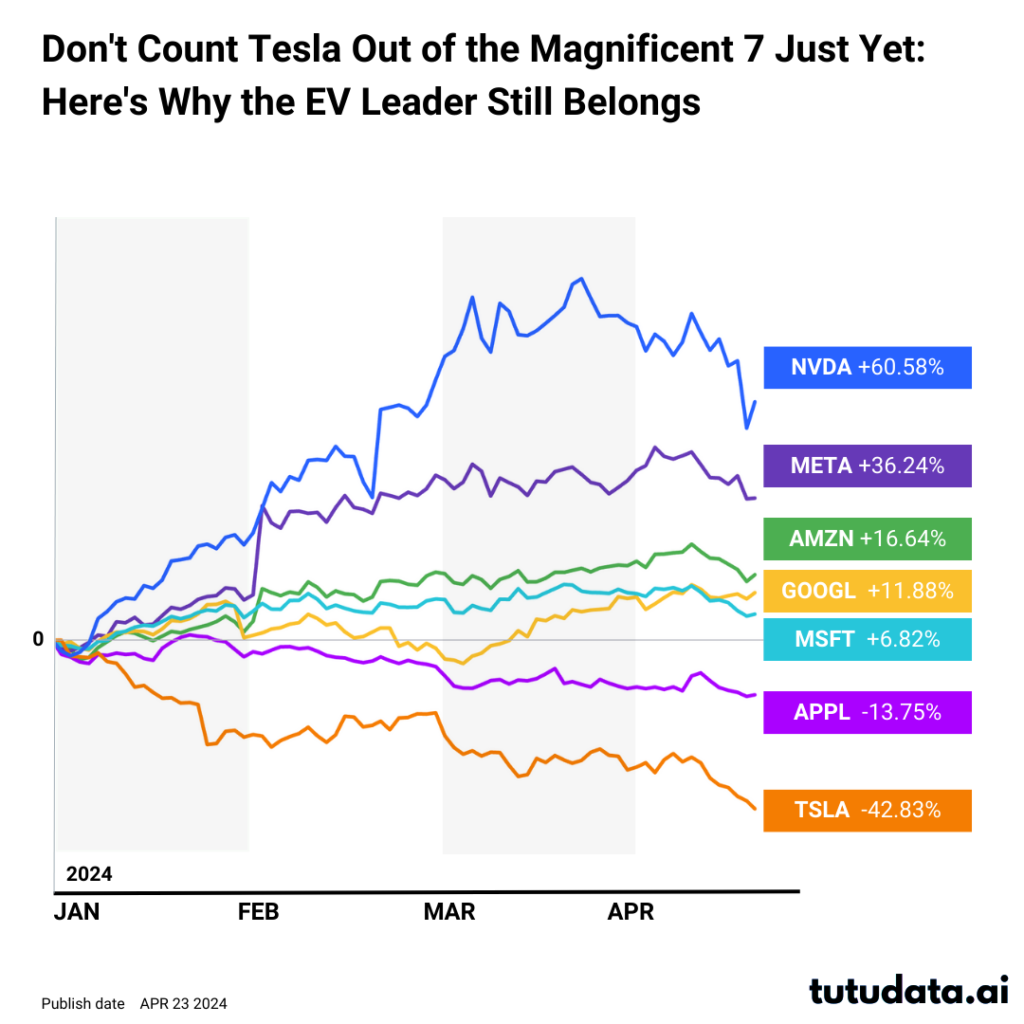

The “Magnificent 7,” a group of high-flying tech stocks, has been a major driver of the stock market in recent years. But with Tesla’s recent stock price performance lagging behind some of its peers in 2024, whispers of removing it from the group are starting to emerge. Here’s why I believe Tesla deserves to keep its place among these tech titans, and why their new robot product adds another layer of exciting potential.

1. It’s Still the EV King: Let’s not forget, Tesla is the undisputed leader in the electric vehicle (EV) revolution. They hold a dominant market share, and with the EV market projected for explosive growth, Tesla is perfectly positioned to capitalize. While competitors are emerging, Tesla’s brand recognition and loyal customer base are a force to be reckoned with.

2. Innovation Engine: Tesla isn’t just about selling cars; it’s about pushing the boundaries of technology. Their constant advancements in battery technology, autonomous driving, and sustainable energy solutions are a major reason for their continued relevance. This focus on innovation could lead to future breakthroughs that propel them even further ahead, and their recently unveiled humanoid robot, Optimus, is a prime example.

3. A New Frontier: The Rise of Tesla Bots: Optimus has the potential to disrupt numerous industries by automating tasks currently done by humans. Manufacturing, logistics, and even elder care could be revolutionized by these robots. The potential market size for humanoid robots is estimated to be in the hundreds of billions of dollars within the next decade, and Tesla is at the forefront of this exciting new frontier.

4. Short-Term Hiccups vs. Long-Term Potential: Sure, Tesla might be facing some production scaling challenges currently. But they’re actively building new Gigafactories worldwide to address this. The bigger picture is the long-term potential. The EV market is still in its early stages, and Tesla has a significant head start with a passionate and innovative team. The potential of their robot product adds another layer of future growth to consider.

5. Looking Beyond the Stock Price: While short-term stock fluctuations can be noisy, they don’t always reflect a company’s true potential. Tesla’s long-term vision for sustainable transportation, its continuous advancements in a rapidly growing market, and its foray into humanoid robotics are more important indicators of future success.

Here to Stay: Tesla may not be outperforming every member of the Magnificent 7 right now, but its role as a disruptive force, its dominance in the EV market, its commitment to innovation, and its new robot product solidify its place amongst these tech leaders. Don’t underestimate the power of this electric car pioneer – it’s just getting started.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult with a financial professional before making any investment decisions.