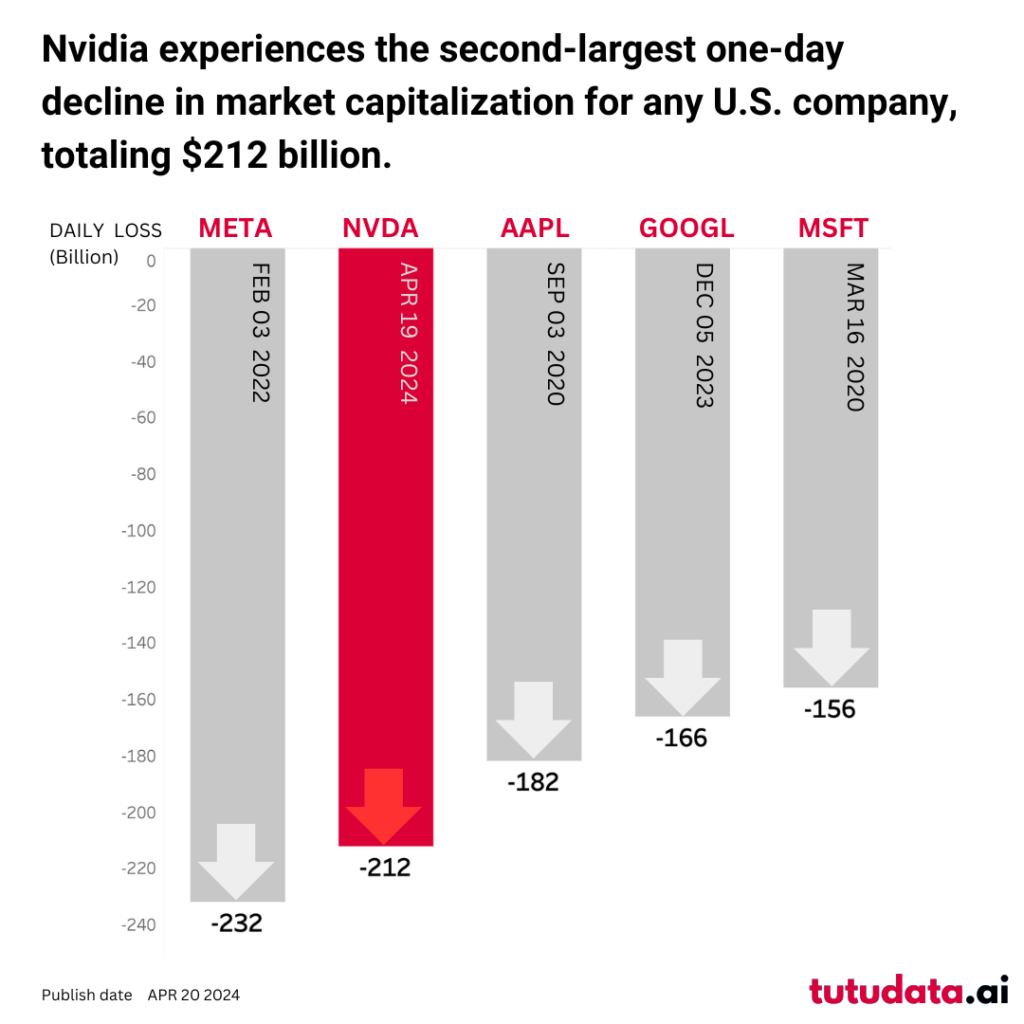

On April 20 2024, Nvidia Corporation (NVDA) witnessed a significant decline in its stock price, resulting in the second-largest single-day market capitalization loss for any U.S. company. This report analyzes the extent of the loss, compares it to historical occurrences, and explores potential contributing factors.

Market Cap Decline

Nvidia’s share price dropped by 10% during the trading session on April 20 2024, leading to a market capitalization decline of approximately $212 billion according to Dow Jones Market Data. This magnitude surpasses all single-day market cap losses in U.S. history except for Meta Platforms Inc. (META), which experienced a $232 billion loss on February 3rd, 2022.

The market capitalization decline of $212 billion is noteworthy as it exceeds the current market valuation of major chip industry peers like Intel Corporation (INTC) at $146 billion and Qualcomm Incorporated (QCOM) at $176 billion (as of market close on April 20 2024).

Historical Context

This incident marks the largest single-day decline for Nvidia since March 16th, 2020, when their share price dropped by 18.5%. While the specific reasons behind the recent market movement remain unclear, further investigation is needed to identify potential contributing factors.

Future Considerations

Understanding the factors that triggered this substantial market cap decline is crucial for investors and industry analysts. By analyzing relevant market data, news reports, and company announcements, future research can aim to identify potential causes and assess their long-term implications for Nvidia and the broader chip industry.